UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )1)

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material underPursuant to §240.14a-12 |

|

CENTER COASTCenter Coast Brookfield MLP & INFRASTRUCTURE FUNDEnergy Infrastructure Fund

|

(Exact Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials.materials: |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

Important Notice to Shareholders of

Center Coast MLP & Infrastructure Fund (the "Fund")

December 8, 2017

Although we recommend that you read the complete Proxy Statement, for your convenience, we have provided a brief overview of the issues to be voted on.

Q. Why am I receiving this Proxy Statement?

A. You are being asked to vote on several important matters affecting the Fund:

(1) Approval of a New Investment Advisory Agreement. Center Coast Capital Advisors, LP (the "Advisor") serves as the Fund's investment adviser. Center Coast Capital Holdings, LLC ("Center Coast"), the parent company of the Advisor, recently announced its intention to be acquired by Brookfield Investment Management Inc. ("BIM"), a wholly-owned subsidiary of Brookfield Asset Management Inc. ("Brookfield") (the "Transaction"). The closing of the Transaction will be deemed to cause an "assignment" of the current investment advisory agreement between the Advisor and the Fund. In order to provide for continuity of advisory services for the Fund after the closing of the Transaction, the Board of Trustees of the Fund (the "Board" or "Board of Trustees") is requesting that you vote to approve a new investment advisory agreement between the Fund and BIM pursuant to which the current portfolio managers of the Fund, who will become employees of BIM upon the closing of the Transaction, would continue to manage the Fund.

(2) Approval of Trustee Nominees. In connection with the Transaction, the Board of Trustees has nominated for election five trustee nominees ("Trustee Nominees"). Each Trustee Nominee currently serves as a member of the boards of the funds in the Brookfield fund complex. The Board of Trustees believes that election of the Trustee Nominees will facilitate the integration of the Fund into the Brookfield fund complex. If elected by shareholders, upon the closing of the Transaction the Trustee Nominees would be seated as trustees of the Fund and the term of each current trustee would end. The election of the Trustee Nominees is contingent on the closing of the Transaction. If the Transaction is not consummated, the Trustee Nominees will not join the Board of Trustees. Information regarding each Trustee Nominee is included in the enclosed proxy statement.

The proposals will be presented to shareholders at a Special Meeting of Shareholders to be held on January 23, 2018. The Proxy Statement includes a detailed discussion of the proposals, which we recommend you read carefully.

The Board of Trustees, including the Independent Trustees, unanimously recommends that you vote FOR each proposal.

Your vote is very important, regardless of how many shares you own. We encourage you to participate in the Fund's governance by returning your vote as soon as possible. If enough shareholders do not cast their votes, the Fund may not be able to hold its meeting or the vote on each proposal, and additional solicitation efforts may be needed in order to obtain sufficient shareholder participation.

Q. How will I as a Fund shareholder be affected by the Transaction?

A. Your Fund investment will not change as a result of the acquisition of Center Coast by Brookfield. You will still own the same Fund shares before and after the Transaction. While BIM will replace the Advisor as investment adviser to the Fund, the current portfolio managers of the Fund will become employees of BIM and will continue to manage the Fund according to the same objectives and policies as before, and do not anticipate any significant changes to the Fund's investment operations. Shareholders may benefit as a result of the Center Coast team being able to take advantage of the depth and breadth of personnel, resources and experience of the broader BIM and Brookfield organizations. The integration of the Fund into the Brookfield fund complex may benefit Fund shareholders through operating efficiencies and increased administrative support.

BIM is an investment adviser registered with the Securities and Exchange Commission and represents the Public Securities platform of Brookfield. BIM provides global listed real assets strategies including real estate equities, infrastructure equities, real asset debt and diversified real assets. With over $16 billion of assets under management as of September 30, 2017, BIM manages separate accounts, registered funds and opportunistic strategies for institutional and individual clients, including financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net worth investors. BIM is a wholly owned subsidiary of Brookfield, a leading global alternative asset manager with over $265 billion of assets under management as of September 30, 2017.

Q. Will there be any change to the Fund's management fee?

A. No. There will be no change in the contractual management fees you pay. Certain other changes to the terms of the investment management agreement are described in the enclosed proxy statement.

Q. What will happen if shareholders of the Fund do not approve the new investment advisory agreement before consummation of the Transaction?

A. Consent of each registered investment company managed by the Advisor, including the Fund, is a condition to the closing of the Transaction. For purposes of satisfying this consent condition, the Fund will be deemed to have consented only if shareholders approve the new investment advisory agreement and the election of the Trustee Nominees. Therefore, the Transaction is not expected to be consummated prior to approval by shareholders of the new investment advisory agreement. However, if shareholders have not yet approved the new investment advisory agreement

and BIM were to waive the applicable closing condition, BIM may manage the Fund under an interim investment advisory agreement, but must place its compensation for its services during this interim period in escrow, pending shareholder approval of the new investment advisory agreement. The Board of Trustees urges you to vote without delay in order to avoid potential disruption to the Fund's operations.

Q. Who do I call if I have questions?

A. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call AST Fund Solutions, LLC, the Fund's proxy solicitor, at (800) 991-5628 with your proxy material.

Q. How do I vote my shares?

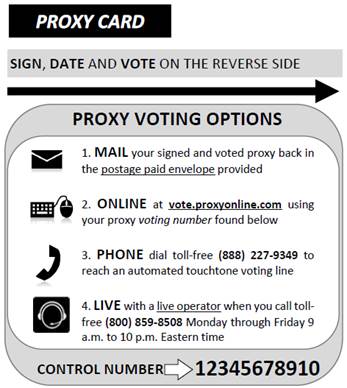

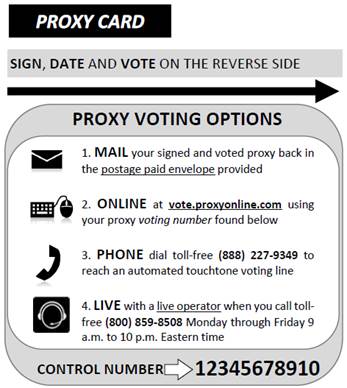

A. You can vote your shares by completing and signing the enclosed proxy card, and mailing it in the enclosed postage-paid envelope. Alternatively, you may vote by telephone by calling the toll-free number on the proxy card or by computer by going to the Internet address provided on the proxy card and following the instructions, using your proxy card as a guide.

Q. Will anyone contact me?

A. You may receive a call from AST Fund Solutions, LLC, the Fund's proxy solicitor, to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote your proxy.

CENTER COAST BROOKFIELD MLP & ENERGY INFRASTRUCTURE FUND

1600 SmithBrookfield Place, 250 Vesey Street Suite 3800

Houston, Texas 77002New York, New York 10281-1023

NOTICE OF SPECIAL2021 ANNUAL MEETING OF SHAREHOLDERS

April 22, 2021

To be held on January 23, 2018the Shareholders:

Notice is hereby given to holders of common shares of beneficial interest, par value $0.01 per share ("Common Shares"), and holders of Series A Mandatory Redeemable Preferred Shares of beneficial interest, par value $0.01 per share, liquidation preference $25,000 per share ("Preferred Shares," and together with the Common Shares, the "Shares") of Center Coast Brookfield MLP & Energy Infrastructure Fund, ("CEN" ora Delaware statutory trust (the "Fund"), that the "Fund") that a special meeting2021 Annual Meeting of shareholders of the FundShareholders (the "Meeting") will be held on Thursday, May 20, 2021, at the offices of Center Coast Capital Advisors, LP, 1600 Smith Street, Suite 3800, Houston, Texas 77002 on Tuesday, January 23, 2018, at 3:30 p.m. (Central time). The Meeting is being held8:45 a.m., Eastern Time, for the following purposes:

1. To approve a new investment advisory agreement betweenconsider and vote upon the Fundelection of the Class I Trustees by holders of Shares, each to serve until the third annual meeting following his election and Brookfield Investment Management Inc.until his successor is duly elected and qualifies (Proposal 1).

2. To elect trustee nominees as follows:

(a) trustee nominees to be elected by holders of Common Shares and Preferred Shares voting as a single class:

(i) as a Class I Trustee, the Trustee Nominee named in the accompanying proxy statement (Mr. David Levi) to hold office until the Fund's 2018 annual meeting or until his successor has been elected and qualified;

(ii) as a Class II Trustee, the Trustee Nominee named in the accompanying proxy statement (Mr. Edward A. Kuczmarski) to hold office until the Fund's 2019 annual meeting or until his successor has been elected and qualified;

(iii) as a Class III Trustee, the Trustee Nominee named in the accompanying proxy statement (Mr. Louis P. Salvatore) to hold office until the Fund's 2020 annual meeting or until his successor has been elected and qualified;

(b) trustee nominees to be elected by holders of Preferred Shares voting as a separate class:

(i) as a Class II Trustee, the Trustee Nominee named in the accompanying proxy statement (Mr. Stuart A. McFarland) to hold office until the Fund's 2019 annual meeting or until his successor has been elected and qualified;

(ii) as a Class III Trustee, the Trustee Nominee named in the accompanying proxy statement (Ms. Heather S. Goldman) to hold

office until the Fund's 2020 annual meeting or until her successor has been elected and qualified;

3. To transact suchany other business asthat may properly come before the Meeting or any adjournments, postponementsadjournment or delayspostponement thereof.

THE BOARD OF TRUSTEES OF THE FUND (THE "BOARD"), INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" APPROVAL OF THE NEW INVESTMENT ADVISORY AGREEMENT AND "FOR" EACH OF THE TRUSTEE NOMINEES NAMED IN THE ACCOMPANYING PROXY STATEMENT.

The Board has fixedof Trustees recommends that you vote "FOR" the nominees named in the proxy statement.

Due to the public health impact of the coronavirus pandemic (COVID-19), and to support the health and well-being of Fund shareholders, the Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Meeting in person. In order to participate in and vote at the Meeting, shareholders of record as of the close of business on November 30, 2017 as the record dateApril 15, 2021 (the "Record Date") need to register for the determinationMeeting. If you are a registered holder, and wish to attend and vote at the Meeting, please send an email including your full name and address to the Fund's proxy solicitor, AST Fund Solutions, LLC ("AST"), at attendameeting@astfinancial.com with "Center Coast Brookfield MLP & Energy Infrastructure Fund virtual meeting" in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting. If you hold your Shares beneficially through a bank or broker, you will receive information regarding how to instruct your bank or broker to cast your vote. If you wish to attend and vote at the Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund's name, the number of shareholdersShares you held as of the Record Date, as well as your name and address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy via email to AST at attendameeting@astfinancial.com with "Legal Proxy" in the subject line. After receiving this information, AST will then email

you the virtual meeting access information and instructions for voting during the Meeting.

Shareholders of record on the Record Date are entitled to notice of, and to vote at, the Meeting andor any adjournments, postponementsadjournment or delayspostponement thereof.

It is important that your shares be represented You are being asked to participate at the Meeting in personeither virtually or by proxy. Whether or notIf you attend the Meeting and are a shareholder of record as of the close of business on the Record Date, you may vote your Shares at the Meeting. Regardless of whether you plan to attend the Meeting, we urgeplease complete, date, sign and return promptly in the enclosed envelope the accompanying proxy. This is important to ensure a quorum at the Meeting.

In addition to authorizing a proxy to vote by mail, you may also authorize a proxy to complete, sign, date,vote your Shares via the Internet or telephone, as follows:

To vote by the Internet:

(1) Read the Proxy Statement and returnhave the enclosed proxy card in the postage-paid envelope provided or vote via telephone or the Internet pursuantat hand.

(2) Go to the instructionswebsite that appears on the enclosed proxy card.

(3) Enter the control number set forth on the enclosed proxy card soand follow the simple instructions.

To vote by telephone:

(1) Read the Proxy Statement and have the enclosed proxy card at hand.

(2) Refer to the toll-free number that appears on the enclosed proxy card.

(3) Follow the instructions.

We encourage you to authorize a proxy to vote your Shares via the Internet using the control number that appears on your enclosed proxy card. Use of Internet voting will be represented atreduce the Meeting.time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote. If you attendshould have any questions about this Notice or the Meeting and wishproxy materials, we encourage you to vote in person, you will be able to do so and your votecall us at the Meeting will revoke any proxy you may have submitted. Merely attending the Meeting, however, will not revoke any previously submitted proxy.(855) 777-8001.

Thank you for your considerationBy Order of the proposals. We value you as a shareholder and look forward to our continued relationship.

By orderBoard of the Board:Trustees,

/s/ Dan C. TutcherThomas D. Peeney

Dan C. TutcherThomas D. Peeney

Trustee, PresidentSecretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 20, 2021

The Fund's Notice of 2021 Annual Meeting of Shareholders, Proxy Statement and Chief Executive OfficerForm of Proxy are available on the Internet at https://publicsecurities.brookfield.com/en.

Houston, Texas

December 8, 2017WE NEED YOUR PROXY VOTE IMMEDIATELY.

YOU MAY THINK YOUR VOTE IS NOT IMPORTANT, BUT IT IS VITAL. AT THE MEETING OF SHAREHOLDERS, THE FUND WILL BE UNABLE TO CONDUCT ANY BUSINESS IF LESS THAN A MAJORITY OF THE VOTES ENTITLED TO BE CAST ARE REPRESENTED. IN THAT EVENT, THE MEETING MAY BE ADJOURNED AND THE FUND, AT THE SHAREHOLDERS' EXPENSE, WOULD CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO ACHIEVE A QUORUM. CLEARLY, YOUR VOTE COULD BE CRITICAL TO ENABLE THE FUND TO HOLD THE MEETING AS SCHEDULED, SO PLEASE RETURN YOUR PROXY CARD IMMEDIATELY. YOU AND ALL OTHER SHAREHOLDERS WILL BENEFIT FROM YOUR COOPERATION.

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts. Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts. Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration.

3. All Other Accounts. The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

Registration | | Valid Signature | |

Corporate Accounts

(1) ABC Corp.

| | ABC Corp. (by John Doe,

Treasurer) | |

| (2) ABC Corp. | | John Doe, Treasurer | |

| (3) ABC Corp. c/o John Doe, Treasurer | | John Doe | |

| (4) ABC Corp. Profit Sharing Plan | | John Doe, Director | |

Trust Accounts

| (1) ABC Trust | | Jane B. Doe, Director | |

| (2) Jane B. Doe, Director u/t/d 12/28/78 | | Jane B. Doe | |

Custodial or Estate Accounts

(1) John B. Smith, Cust.

f/b/o John B. Smith, Jr.

UGMA | | John B. Smith | |

| (2) John B. Smith | | John B. Smith, Jr., Executor | |

YOUR VOTE IS IMPORTANT

IMPORTANT. PLEASE COMPLETE, SIGN, DATE AND RETURN THE ENCLOSEDAUTHORIZE A PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED ORTO VOTE VIA TELEPHONE OR THE INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD. IN ORDER TO SAVE THE FUND ANY ADDITIONAL EXPENSE OF FURTHER SOLICITATION, PLEASE MAIL YOUR PROXY CARD OR VOTE VIA TELEPHONE OR THE INTERNET PROMPTLY.

IF YOU WISH TO ATTEND THE MEETING AND VOTE IN PERSON, YOU WILL BE ABLE TO DO SO. IF YOU INTEND TO ATTEND THE MEETING IN PERSON AND YOU ARE A RECORD HOLDER OF SHARES, IN ORDER TO GAIN ADMISSION YOU MUST SHOW PHOTOGRAPHIC IDENTIFICATION, SUCH AS YOUR DRIVER'S LICENSE. IF YOU INTEND TO ATTEND THE MEETING IN PERSON AND YOU HOLD YOUR SHARES THROUGH A BANK, BROKER OR OTHER CUSTODIAN, IN ORDER TO GAIN ADMISSIONPROMPTLY, NO MATTER HOW MANY SHARES YOU MUST SHOW PHOTOGRAPHIC IDENTIFICATION, SUCH AS YOUR DRIVER'S LICENSE, AND SATISFACTORY PROOF OF OWNERSHIP OF SHARES, SUCH AS YOUR VOTING INSTRUCTION FORM (OR A COPY THEREOF) OR BROKER'S STATEMENT INDICATING OWNERSHIP AS OF A RECENT DATE. IF YOU HOLD YOUR SHARES IN A BROKERAGE ACCOUNT OR THROUGH A BANK OR OTHER NOMINEE, YOU WILL NOT BE ABLE TO VOTE IN PERSON AT THE MEETING UNLESS YOU HAVE PREVIOUSLY REQUESTED AND OBTAINED A "LEGAL PROXY" FROM YOUR BROKER, BANK OR OTHER NOMINEE AND PRESENT IT AT THE MEETING.OWN.

CENTER COAST BROOKFIELD MLP & ENERGY INFRASTRUCTURE FUND (NYSE: CEN)

Brookfield Place, 250 Vesey Street

New York, New York 10281-1023

PROXY STATEMENT

FOR

SPECIAL MEETING OF SHAREHOLDERS

To be held on January 23, 2018

This proxy statement ("Proxy Statement")Statement is furnished to the holders of common shares of beneficial interest, par value $0.01 per share ("Common Shares") and holders of Series A Mandatory Redeemable Preferred Shares of beneficial interest, par value $0.01 per share, liquidation preference $25,000 per share ("Preferred Shares," and together with the Common Shares, the "Shares") of Center Coast Brookfield MLP & Energy Infrastructure Fund, ("CEN" or thea Delaware statutory trust (the "Fund") in connection with the solicitation by the Board of Trustees of the Fund (the "Board" or the "Board of Trustees"), of proxies to be votedexercised at the special meeting2021 Annual Meeting of shareholdersShareholders (the "Meeting") of the Fund to be held on Tuesday, January 23, 2018 andThursday, May 20, 2021 at 8:45 a.m., Eastern Time (and at any adjournments,adjournment or postponements or delays thereof (the "Meeting"). The Meeting will be held atthereof) for the offices of Center Coast Capital Advisors, LP, 1600 Smith Street, Suite 3800, Houston, Texas 77002, on Tuesday, January 23, 2018, at 3:30 p.m. (Central time).

This document will give you the information you need to vote on the matters listed onpurposes set forth in the accompanying Notice of SpecialAnnual Meeting of Shareholders (the "Notice"). Much of the information in this Proxy Statement is required under rules of the Securities and Exchange Commission ("SEC"). If there is anything you don't understand, please contact AST Fund Solutions, LLC, the Fund's proxy solicitor at (800) 991-5628.

The Fund will furnish to any shareholder, without charge, a copy of the Fund's most recent annual report to shareholders upon request. Requests should be directed to the Fund, c/o Center Coast Capital Advisors, LP, 1600 Smith Street, Suite 3800, Houston, Texas 77002, or by calling (800) 991-5628.

The Notice, thisShareholders. This Proxy Statement and the enclosedaccompanying form of proxy card(s) are first being sent to the Fund's shareholders on or about December 8, 2017.April 22, 2021.

Due to the public health impact of the coronavirus pandemic (COVID 19) and to support the health and well-being of Fund shareholders, the Meeting will be held solely on the internet by virtual means. You will not be able to attend the Meeting in person.

The Meeting is being held forpersons named as proxy holders on the following purposes:

1. To approve a new investment advisory agreement betweenproxy card will vote in accordance with your instructions and, unless specified to the Fund and Brookfield Investment Management Inc.

2. To elect trustee nominees as follows:

(a) trustee nominees to be elected by holderscontrary, will vote "FOR" the election of Common Shares and Preferred Shares voting as a single class:

(i) as athe Class I Trustee the Trustee Nominee named in this proxy statement (Mr. David Levi), to hold office until the Fund's 2018 annual meeting or until his successor has been elected and qualified;

(ii) as a Class II Trustee, the Trustee Nominee named in this proxy statement (Mr. Edward A. Kuczmarski), to hold office until the Fund's 2019 annual meeting or until his successor has been elected and qualified;

(iii) as a Class III Trustee, the Trustee Nominee named in this proxy statement (Mr. Louis P. Salvatore), to hold office until the Fund's 2020 annual meeting or until his successor has been elected and qualified;

(b) trustee nominees to be elected by holders of Preferred Shares voting as a separate class:

(i) as a Class II Trustee, the Trustee Nominee named in this proxy statement (Mr. Stuart A. McFarland), to hold office until the Fund's 2019 annual meeting or until his successor has been elected and qualified;

(ii) as a Class III Trustee, the Trustee Nominee named in this proxy statement (Ms. Heather S. Goldman), to hold office until the Fund's 2020 annual meeting or until her successor has been elected and qualified;

3. To transact such other business as may properly come before the Meeting or any adjournments, postponements or delays thereof.

nominees. The Board unanimously recommends that you vote "FOR" approval of the new investment advisory agreement and "FOR" each of the trustee nominees named in this proxy statement.

Shareholders of record of the Fund at the close of business on November 30, 2017April 15, 2021, has been fixed as the record date (the "Record Date") arefor the determination of shareholders entitled to be present at the Meeting and any adjournments, postponements or delays thereofreceive notice of, and to vote onat, the Proposal.Meeting. Each Share is entitled to one vote onfor each Proposal (except that with respect to Proposal 2(b) only Preferred Shares shall vote formatter properly presented at the election of the trustee nominees standing for election by holders of Preferred Shares voting as a separate class). Shares represented by duly executed proxies willMeeting. Votes may not be voted in accordance with your instructions.cumulated. At the close of business on the Record Date, the Fund had 24,451,078 Common Shares and 2,000 Preferred Shares outstanding.

Whether or not you plan to attend the Meeting, we urge you to complete, sign, date, and return the enclosed proxy card in the postage-paid envelope provided or vote via telephone or the Internet so your Shares will be represented at the Meeting. Instructions regarding how to vote via telephone or the Internet are included on the enclosed proxy card. The required control number for Internet and telephone voting is printed on the enclosed proxy card. The control number is used to match proxy cards with shareholders' respective accounts and to ensure that, if multiple proxy cards are executed, Shares are voted in accordance with the proxy card bearing the latest date.

If you wish to attend the Meeting and vote in person, you will be able to do so. If you intend to attend the Meeting in person and you are a record holder of Shares, in order to gain admission you must show photographic identification, such as your driver's license. If you intend to attend the Meeting in person and you hold your Shares through a bank, broker or other custodian, in order to gain admission you must show photographic identification, such as your driver's license, and satisfactory proof of ownership of Shares, such as your voting instruction form (or a copy thereof) or broker's statement indicating ownership as of a recent date. If you hold your Shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Meeting unless you have previously requested and obtained a "legal proxy" from your broker, bank or other nominee and present it at the Meeting.

You may contact the Fund's proxy solicitor at (800) 991-5628 to obtain directions to the site of the Meeting.

All Shares represented by properly executed proxies received prior to the Meeting will be voted at the Meeting in accordance with the instructions marked thereon or otherwise as provided therein. If any other business is brought before the Meeting, your Shares will be voted at the proxies' discretion. If you sign the proxy card, but don't fill in a vote, your Shares will be voted in accordance with the Board's recommendation.

Shareholders who execute proxy cards or record their voting instructions via telephone or the Internet may revoke them at any time before they are voted by filing with the Secretary of the Fund a written notice of revocation, by delivering (including via telephone or the Internet) a duly executed proxy bearing a later date or by attending the Meeting and voting in person. Merely attending the Meeting, however, will not revoke any previously submitted proxy.

Broker-dealer firms holding Shares in "street name" for the benefit of their customers and clients will request the instructions of such customers and clients on how to vote their Shares on the proposal before the Meeting. The Fund understands that, under the rules of the NYSE, such broker-dealer firms may for certain "routine" matters, without instructions from their customers and clients, grant discretionary authority to the proxies designated by the Board to vote if no instructions have been received prior to the date specified in the broker-dealer firm's request for voting instructions. Proposal 2 is a "routine" matter and beneficial owners who do not provide proxy instructions or who do not return a proxy card may have their Shares voted by broker-dealer firms in favor of the proposal. A properly executed proxy card or other authorization by a beneficial owner of Shares that does not specify how the beneficial owner's Shares should be voted on the proposal may be deemed an instruction to vote such Shares in favor of the proposal. Broker-dealers who are not members of the NYSE may be subject to other rules, which may or may not permit them to vote your Shares without instruction. We urge you to provide instructions to your broker or nominee so that your votes may be counted.

PROPOSAL 1: APPROVAL OF NEW INVESTMENT ADVISORY AGREEMENT

Background4,929,945 Shares.

Under an investment advisory agreement between Center Coast Capital Advisors, LP (the "Advisor") and the Fund, dated asDeclaration of September 25, 2013 (the "Current Advisory Agreement"), the Advisor serves as the Fund's investment adviser and is responsible for the management of the Fund. The Current Advisory Agreement was approved by the initial shareholder of the Fund on September 20, 2013 and the continuation of the Current Advisory Agreement was last approved by the Board of Trustees on May 25, 2017.

On October 9, 2017, Center Coast Capital Holdings, LLC ("Center Coast") and the equity holders of Center Coast (including Dan C. Tutcher, Founder and Principal Center Coast and Trustee, President, Chief Executive Officer of the Fund) entered into a Membership Units Purchase Agreement (the "Purchase Agreement") with Brookfield Ranger I LLC ("Acquisition Co.") and Brookfield Investment Management Inc. ("BIM") pursuant to which BIM, through its wholly-owned subsidiary, Acquisition Co., would acquire Center Coast (the "Transaction"), for an aggregate purchase price that includes approximately $84 million of initial cash consideration, subject to certain pre-closing and post-closing purchase price adjustments as set forth in the Purchase Agreement, plus additional contingent consideration payments to be paid in years two and four following the closing of the transaction calculated based on the performance of the business and subject to certain conditions as set forth in the Purchase Agreement.

BIM is an investment adviser registered with the SEC and represents the Public Securities platform of Brookfield. BIM provides global listed real assets strategies including real estate equities, infrastructure equities, real asset debt and diversified real assets. With over $16 billion of assets under management as of September 30, 2017, BIM manages separate accounts, registered funds and opportunistic strategies for institutional and individual clients, including financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net worth investors. BIM is a wholly owned subsidiary of Brookfield, a leading global alternative asset manager with over $265 billion of assets under management as of September 30, 2017.

Following the closing of the Transaction, the Center Coast team would become part of the Brookfield Public Securities Group, which specializes in listed real asset investment opportunities, in both equity and debt. The Brookfield Public Securities Group has a 30-year history of active investment in public markets and offers actively managed strategies through separately managed accounts, mutual funds, UCITS funds, closed-end funds and private hedge funds. As of September 30, 2017, the Brookfield Public Securities Group had over $16 billion in assets under management.

Following the Transaction, the current portfolio managers of the Fund will become employees of BIM and will continue to manage the Fund according to the same

objectives and policies as before and do not anticipate any significant changes to the Fund's investment operations.

The Current Advisory Agreement, as required by Section 15 of the Investment Company Act of 1940 (the "1940 Act"), provides for its automatic termination in the event of its "assignment" (as defined in the 1940 Act). The consummation of the Transaction will result in a change in control of the Advisor and therefore cause the automatic termination of the Current Advisory Agreement, as required by the 1940 Act.

Completion of the Transaction is subject to a number of conditions, including obtaining consents of clients representing a certain percentage of the Advisor's run rate revenue and the consent of each registered investment company managed by the Advisor, including the Fund. Under the terms of the Purchase Agreement, for purposes of satisfying this consent condition, the Fund will be deemed to have consented only if shareholders approve the New Advisory Agreement (as defined below) and the election of the Trustee Nominees, as described in Proposal 2. Center Coast and Brookfield currently expect to close the Transaction in the first quarter of 2018.

The Proposal

Shareholders of the Fund are being asked to approve a new investment advisory agreement between the Fund and BIM, to take effect upon the closing of the Transaction or shareholder approval, whichever is later (the "New Advisory Agreement").

At an in-person meeting of the Board on July 24, 2017, and for the reasons discussed below, the Board of Trustees, including the Trustees who are not "interested persons" (as defined in Section 2(a)(19) of the 1940 Act)Trust of the Fund, the Advisor or BIM (the "Independent Trustees"), unanimously approved the New Advisory Agreement and unanimously recommended approval of the New Advisory Agreement by shareholders. For additional information regarding the Board's consideration of the New Advisory Agreement, see "Board Considerations" below. The form of the New Advisory Agreement is attached hereto as Appendix A to this Proxy Statement.

Comparison of Current Advisory Agreement and New Advisory Agreement

The terms of each New Advisory Agreement are similar to those of the Current Advisory Agreement. If approved by shareholders of the Fund, the New Advisory Agreement for the Fund will have an initial term of two years and will continue in effect from year to year thereafter if such continuance is approved at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. Below is a comparison of certain terms of the Current Advisory Agreement to the terms of the New Advisory Agreement. For additional information regarding the New Advisory Agreement, see the form of the New Advisory Agreement that is attached as Appendix A to this Proxy Statement.

Investment Management Services. The investment advisory services to be provided by BIM to the Fund under the New Advisory Agreement are substantially the same as the investment advisory services provided by the Advisor under the Current

Advisory Agreement. Further, the investment advisory services are expected to be provided by the same personnel under the New Advisory Agreement as under the Current Advisory Agreement.

The Current Advisory Agreement provides that the Advisor conduct a continual program of investment and reinvestment of the Fund's assets and manage the Fund's assets in accordance with the investment objective, policies and restrictions of the Fund, including determining what portion of such assets will be invested or held uninvested from time to time. The Current Advisory Agreement also provides that the Advisor is authorized, in its sole discretion, to: (i) obtain and evaluate pertinent information relating to the economy, financial markets and the Fund's current or potential investments; (ii) make investment decisions for the Fund; (iii) place purchase and sale orders for portfolio transactions on behalf of the Fund, lend securities and manage otherwise uninvested cash assets of the Fund; (iv) execute account documentation, agreements, contracts and other documents as may be requested by brokers, dealers, counterparties and other persons in connection with the Advisor's management of the assets of the Fund; (v) employ professional portfolio managers and securities analysts who provide research services to the Fund; (vi) make decisions with respect to the use by the Fund of borrowing for leverage or other investment purposes and the use of derivative instruments the Fund; (vii) vote proxies relating to securities held by the Fund and make decisions with respect to waivers, consents and amendments to the terms of securities held by the Fund; and (viii) take such action as is appropriate to effectively manage the Fund's investment practices. Under the Current Advisory Agreement, the Advisor also performs certain management services, including providing the Fund with office space, facilities, equipment and necessary personnel, and conducting, on behalf of the Fund, affairs with custodians, depositaries, transfer agents, pricing agent, dividend reimbursing agents, other shareholder servicing agents, accountants, attorneys, underwriters, brokers and dealers, corporate fiduciaries, insurers, banks and such other persons in any such other capacity deemed to be necessary or desirable.

The terms of the New Advisory Agreement ensure that substantially the same investment advisory services are provided by BIM to the Fund. The New Advisory Agreement provides that BIM shall (i) furnish continuously an investment program for the Fund, (ii) determine the investments to be purchased, held, sold or exchanged by the Fund and the portion, if any, of the assets of the Fund to be held uninvested, (iii) make changes in the investments of the Fund and (iv) vote, exercise consents and exercise all other rights pertaining to such investments. BIM shall manage, supervise and conduct the other affairs and business of the Fund and matters incidental thereto, subject always to the control of the fund's Board of Trustees, and to the provisions of the organizational documents of the Fund, the registration statement of the Fund, including the Fund's prospectus and statement of additional information, any public filings made pursuant to the Securities Exchange Act of 1934 (the "Exchange Act") or the New York Stock Exchange ("NYSE") requirements, including press releases, and the 1940 Act and other applicable law, in each case as from time to time amended and in effect. The New Advisory Agreement provides that BIM may delegate any or all of its responsibilities to one or more investment sub-advisers, which sub-advisers may be affiliates of BIM; provided, however, that BIM shall remain responsible to the Fund

with respect to its duties under the New Advisory Agreement. No such delegation is required and any such delegation would be subject to approval by the Board of Trustees and shareholders of the Fund, to the extent required by the 1940 Act.

Fees. Under each of the Current Advisory Agreement and the New Advisory Agreement, the Fund pays to the respective adviser an investment advisory fee at an annual rate of 1.00% of the Fund's average daily "Managed Assets" payable monthly in arrears. Under both the Current Advisory Agreement and New Advisory Agreement, Managed Assets includes the proceeds of leverage. Common shares effectively bear the entire advisory fee. During the time in which the Fund is utilizing leverage, the amount of the fees paid to the investment adviser for investment advisory services will be higher than if the Fund did not utilize leverage. The New Advisory Agreement defines "Managed Assets" of the Fund to mean the Fund's average daily net assets, plus the amount of any borrowings for investment purposes. Under the New Advisory Agreement, BIM may waive a portion of its fees and may allocate a portion of its fees to any sub-adviser.

During the fiscal year ended November 30, 2016 (the most recent fiscal year for which such information is available), the Fund paid the Advisor investment advisory fees of $2,923,851.

Payment of Expenses. Under each of the Current Advisory Agreement and the New Advisory Agreement, the Fund is responsible for its own operating expenses. While the New Advisory Agreement also supplements the general provision that the Fund is responsible for its own expenses by listing certain specific categories of such expenses, under each of the Current Advisory Agreement and the New Advisory Agreement, the Fund will be responsible for substantially the same types of operating expenses, and the adoption of the terms of the New Advisory Agreement is not expected to result in any material difference in the operating expenses borne by the Fund.

Under the Current Advisory Agreement, the Fund is responsible for its own operating expenses, including those expenses initially incurred by the Advisor on behalf of the Fund. Further, under the Current Advisory Agreement, the Advisor will bear all costs and expenses of its employees and overhead incurred in connection with its duties under the Current Advisory Agreement and shall bear the costs of any salaries or trustee fees of any officers or trustees of the Fund who are affiliated persons (as defined in the 1940 Act) of the Advisor. The Board of Trustees may, however, approve reimbursement to the Advisor of the pro rata portion of the salaries, bonuses, health insurance, retirement benefits and all similar employment costs for the time spent on Fund operations (including, without limitation, compliance matters), other than the provisions of investment advice and administrative services required under the Current Advisory Agreement, by all personnel employed by the Advisor who devote substantial time to Fund operations. No such reimbursement is currently paid.

The New Advisory Agreement provides that the Fund assumes and shall pay all expenses for all Fund operations and activities and shall reimburse BIM for any such expenses incurred by BIM. Unless stated otherwise in the Fund's prospectus or statement of additional information, the expenses to be borne by the Fund shall include,

without limitation: (a) all expenses of organizing the Fund; (b) the charges and expenses of any registrar, stock transfer or dividend disbursing agent, shareholder servicing agent, custodian or depository appointed by the Fund for the safekeeping of its cash, portfolio securities and other property, including the costs of servicing shareholder investment accounts, and bookkeeping, accounting and pricing services provided to the Fund; (c) the charges and expenses of bookkeeping, accounting and auditors; (d) brokerage commissions and other costs incurred in connection with transactions in the portfolio securities of the Fund, including any portion of such commissions attributable to brokerage and research services as defined in Section 28(e) of the Exchange Act; (e) taxes, including issuance and transfer taxes, and fund registration, filing or other fees payable by the Fund to federal, state or other governmental agencies; (f) expenses relating to the issuance of Common Shares of the Fund; (g) expenses involved in registering and maintaining registrations of the Fund and of its Common Shares with the SEC and various state and other jurisdictions; (h) expenses involved in registering and maintaining registrations of the Fund and of its Common Shares with the NYSE; (i) expenses of shareholders' and trustees' meetings, including meetings of committees, and of preparing, printing and mailing proxy statements, quarterly reports, if any, semi-annual reports, annual reports and other communications to existing shareholders; (j) expenses of preparing and printing prospectuses; (k) compensation and expenses of trustees who are not affiliated with BIM; (l) if approved by the Fund's Board of Trustees, compensation and expenses of the Fund's chief compliance officer and expenses associated with the Fund's compliance program; (m) charges and expenses of legal counsel in connection with matters relating to the Fund, including, without limitation, legal services rendered in connection with the Fund's organization and financial structure and relations with its shareholders, issuance of Common Shares and registration and qualification of Common Shares under federal, state and other laws; (n) the cost and expense of maintaining the books and records of the Fund, including general ledger accounting; (o) insurance premiums on fidelity, errors and omissions and other coverages, including the expense of obtaining and maintaining a fidelity bond as required by Section 17(g) of the 1940 Act which may also cover BIM; (p) expenses incurred in obtaining and maintaining any surety bond or similar coverage with respect to securities of the Fund; (q) interest payable on Fund borrowings; (r) such other non-recurring expenses of the Fund as may arise, including expenses of actions, suits or proceedings to which the Fund is a party and expenses resulting from the legal obligation that the Fund may have to provide indemnity with respect thereto; (s) expenses and fees reasonably incidental to any of the foregoing specifically identified expenses; and (t) all other expenses permitted by the prospectus and statement of additional information of the Fund as being paid by the Fund.

Other Services. Under the Current Advisory Agreement, the Advisor performs various administrative services for the Fund (other than such services, if any, provided by the Fund's custodian, transfer agent, administrator, fund accounting agent, and dividend disbursing agent and other service providers). To the extent requested by the Fund, the Advisor agrees to provide or cause others to provide the following administrative services at the Fund's expense: (i) preparing general shareholder communications, including shareholder reports; (ii) conducting shareholder relations; (iii) maintaining the Fund's

existence and its records; (iv) during such times as shares are publicly offered, maintaining the registration and qualification of the Fund's shares under federal and state law; (v) investigating the development of and developing and implementing, if appropriate, management and shareholder services designed to enhance the value or convenience of the Fund as an investment vehicle; (vi) overseeing the determination and publication of the Fund's net asset value in accordance with the Fund's policy as adopted from time to time by the Board of Trustees; (vii) overseeing the preparation and filing of the Fund's federal, state and local income tax returns and any other required tax returns; (viii) reviewing the appropriateness of and arranging for payment of the Fund's expenses, including fees paid to the Fund's service providers; (ix) preparing (or overseeing the preparation) for review and approval by officers of the Fund financial information for the Fund's semi-annual and annual reports, proxy statements and other communications with shareholders required or otherwise to be sent to Fund shareholders, and arrange for the printing and dissemination of such reports and communications to shareholders; (x) preparing (or overseeing the preparation) for review by an officer of the Fund the Fund's periodic financial reports required to be filed with the SEC on Form N-SAR, N-CSR, N-PX, N-Q and such other reports, forms and filings, as may be mutually agreed upon; (xi) preparing reports relating to the business and affairs of the Fund as may be mutually agreed upon and not otherwise appropriately prepared by the Fund's custodian, counsel or auditors; (xii) preparing (or overseeing the preparation of) such information and reports as may be required by any stock exchange or exchanges on which the Fund's shares are listed; (xiii) making such reports and recommendations to the Board of Trustees concerning the performance and fees of the Fund's custodian, transfer agent, administrator and dividend disbursing agent as the Board of Trustees may reasonably request or deems appropriate; (xiv) reviewing implementation of any share purchase programs authorized by the Board of Trustees; (xv) determining the amounts available for distribution as dividends and distributions to be paid by the Fund to its shareholders; (xvi) preparing and arranging for the printing of dividend notices to shareholders; (xvii) providing the Fund's dividend disbursing agent and custodian with such information as is required for such parties to effect the payment of dividends and distributions and to implement the Fund's dividend reinvestment plan; (xviii) preparing such information and reports as may be required by any party from which the Fund borrows funds; (xix) providing such assistance to the custodian and the Fund's counsel and auditors as generally may be required to properly carry on the business and operations of the Fund; and (xx) assisting in the preparation and filing of Forms 3, 4, and 5 pursuant to Section 16 of the Exchange Act, and Section 30(f) of the 1940 Act for the officers and Trustees of the Fund, such filings to be based on information provided by those persons. Many of the administrative services listed in the Current Advisory Agreement, are currently performed by third parties and it is anticipated that such administrative services will continue to be provided by the same third parties after the closing of the Transaction.

The New Advisory Agreement provides that the Fund and BIM may enter into other agreements pursuant to which BIM will provide administrative or other, non-investment advisory services to the Fund, and BIM may be compensated for such other services.

Limitation on Liability. The Current Advisory Agreement and New Advisory Agreement provide that the respective adviser will not be liable for any error of judgment or mistake of law or for any loss suffered by the Fund in connection with the matters to which the respective advisory agreement relates, except for willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties.

Indemnification. The Current Advisory Agreement and New Advisory Agreement indemnify, subject to certain conditions, the respective adviser against any liabilities and expenses, including amounts paid in satisfaction of judgments, in compromise or as fines and penalties, and counsel fees (all as provided in accordance with applicable state law) reasonably incurred by the respective adviser in connection with the defense or disposition of any action, suit or other proceeding, whether civil or criminal, before any court or administrative or investigative body in which the respective adviser may be or may have been involved as a party or otherwise or with which the respective adviser may be or may have been threatened, while acting in any capacity set forth herein or thereafter by reason of the respective adviser having acted in any such capacity, except with respect to any matter as to which the respective adviser shall have been adjudicated not to have acted in good faith in the reasonable belief that the respective adviser's action was in the best interest of the Fund and furthermore, in the case of any criminal proceeding, so long as the respective adviser had no reasonable cause to believe that the conduct was unlawful. The New Advisory Agreement also provides that the Fund shall indemnify each of BIM's partners, officers, employees, and agents (including any individual who serves at BIM's request as director, officer, partner, trustee or the like of another corporation) and controlling persons.

Continuance. The Current Advisory Agreement for the Fund continues in effect for successive one-year periods after its initial term, if such continuance is specifically approved at least annually by both (a) the vote of a majority of Independent Trustees cast in person at a meeting called for the purpose of voting on the terms of such renewal, and (b) either the Trustees of the Fund or the affirmative voteholders of a majority of the outstanding voting securitiesShares entitled to vote on any matter at a meeting present in person or by proxy shall constitute a quorum for the purposes of conducting business at such meeting of the Fund. The New Advisory Agreement forShareholders. In the Fund will haveevent that a an initial term of two years, and will continue thereafter for successive one-year periods if approved annually in the same manner required under the Current Advisory Agreement.

Termination. The Current Advisory Agreement may be terminated by the Fund (by vote of the Fund's Board of Trustees or by vote of a majority of the voting securities of the Fund) or the Advisor at any time, without the payment of any penalty, upon giving the other party 60 days' notice. The New Advisory Agreement has substantially similar provisions, except that such termination shall be upon not more than 60 days' nor less than 30 days' prior written notice to the other party.

Governing Law. The Current Advisory Agreement is governed by and construed in accordance with the laws of the State of Delaware. The New Advisory Agreement will be construed in accordance with the laws of the State of New York and the State of New York has exclusive jurisdiction over any action, suit, or proceeding, brought in federal or start court, arising out of, or relating to the New Advisory Agreement.

Interim Investment Advisory Agreement

Consent by each registered investment company managed by the Advisor, including the Fund, is a condition to the closing of the Transaction. For purposes of satisfying this consent condition, the Fund will be deemed to have consented only if shareholders approve the New Advisory Agreement and the election of the Trustee Nominees. Therefore, the Transactionquorum is not expected to be consummated prior to approval by shareholders of the New Advisory Agreement.

However, in the event shareholders of the Fund have not yet approved the New Advisory Agreementpresent at the Meeting or any adjournment, postponement or delay thereof, and BIM were to waiveotherwise, the applicable closing condition, BIM may manage the Fund under an interim investment advisory agreement between the Fund and BIM that would take effect upon the closingchairman of the Transaction. In light ofMeeting has the closing condition described above,power to adjourn the Fund doesMeeting from time to time, to a date not expect to enter into an interim advisory agreement; however,more than 180 days after the Record Date without notice other than announcement at the July 24, 2017 meeting,Meeting.

For purposes of determining the Board of Trustees, including the Independent Trustees, unanimously approved an interim advisory agreement (the "Interim Advisory Agreement") the terms of which are substantially identical to those of the Current Advisory Agreement, except for the term and escrow provisions described below. The Interim Advisory Agreement will continue in effect for a term ending on the earlier of 150 days from the closing of the Transaction (the "150-day period") or when shareholders of the Fund approve the New Advisory Agreement. Pursuant to Rule 15a-4 under the 1940 Act, compensation earned by BIM under the Interim Advisory Agreement will be held in an interest-bearing escrow account. If shareholders of the Fund approve the New Advisory Agreement prior to the end of the 150-day period, the amount held in the escrow account under the Interim Advisory Agreement will be paid to BIM. If shareholders of the Fund do not approve the New Advisory Agreement prior to the end of the 150-day period, BIM will be paid the lesser of its costs incurred in performing its services under the Interim Advisory Agreement or the total amount in the escrow account, plus interest earned. At such time, the Board of Trustees would take such action as it believes is in the best interest of the Fund, which may include seeking new management for the Fund or liquidating the Fund.

Information About BIM

BIM, a wholly owned subsidiary of Brookfield, is a Delaware corporation organized in February 1989 and a registered investment adviser under the Investment Advisers Act of 1940, as amended. The business address of BIM and its officers and directors is Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York 10281-1023. As of September 30, 2017, BIM and its subsidiaries had over $16 billion in assets under management. BIM specializes in global listed real assets strategies including real estate equities, infrastructure equities, real asset debt and diversified real assets.

The officers and directors of BIM are:

Name

| | Principal Occupation

| |

Craig Noble

| | CEO, Chief Investment Officer and Portfolio Manager

| |

David Levi

| | President

| |

Kevin English

| | Chief Operating Officer

| |

Brian F. Hurley

| | General Counsel and Interim Chief Compliance Officer

| |

No officer or director of the Fund is an officer, employee, director, general partner or shareholder of BIM. Upon the closing of the Transaction, each officer of the Fund will become an employee and/or officer of BIM or its affiliates. In addition, following the closing of the Transaction, in connection with the integration of the Fund into the Brookfield fund complex, certain officers and employees of Brookfield may be appointed officers of the Fund.

Certain Conditions under the 1940 Act

The Transaction has been structured in reliance upon Section 15(f) of the 1940 Act. Section 15(f) provides in substance that when a salepresence of a controlling interest in an investment adviser occurs, the investment adviser or any of its affiliated persons may receive any amount or benefit in connection with the sale so long as two conditions are satisfied. The first condition of Section 15(f) is that, during the three-year period following the consummation of a transaction, at least 75% of the investment company's board of trustees must not be "interested persons" (as defined in the 1940 Act) of the investment adviser or predecessor adviser. The Fund currently meets this test and will meet this test upon election of the Trustee Nominees described herein. Second, an "unfair burden" (as defined in the 1940 Act, including any interpretations or no-action letters of the Securities and Exchange Commission (the "SEC") or the staff of the SEC) must not be imposed on the investment company as a result of the transaction relating to the sale of such interest, or any express or implied terms, conditions or understandings applicable thereto. The term "unfair burden" (as defined in the 1940 Act) includes any arrangement, during the two-year period after the transaction, whereby the investment adviser (or predecessor or successor adviser), or any "interested person" (as defined in the 1940 Act) of such an adviser, receives or is entitled to receive any compensation directly or indirectly, from the investment company or its security holders (other than feesquorum for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than bona fide ordinary compensation as principal underwriter for the investment company). In the Purchase Agreement, the parties have acknowledged the reliance upon Section 15(f) and have agreed not take or fail to take any action if taking or failure to take (as applicable) such action would have the effect of causing the requirements of any of the provisions of Section 15(f) not to be met. Specifically, Brookfield has agreed to conduct itstransacting business so as to assure that (i) for a period of not less than three (3) years following the closing of the Transaction, at least 75% of the Fund's trustees are not "interested persons" of the Advisor or BIM, and (ii) for a period of not less than two (2) years after the closing, neither Brookfield nor any of its affiliates will

impose or seek to impose on the Fund an "unfair burden" as a result of the Transactions, or any express or implied terms, conditions or understandings applicable thereto.

Other Actions Contemplated in Connection with the Transaction

Contemporaneous with the closing of the Transaction, Brookfield intends to acquire, among other things, certain assets of HRC Fund Associates, LLC and HRC Portfolio Solutions, LLC (the "HRC Asset Acquisition"). Pursuant to the HRC Asset Acquisition, BIM will provide support services to the Fund that are currently being provided by HRC Portfolio Solutions, LLC under the current Fund Support Services Agreement (the "Current Support Services Agreement") between the Fund and HRC Portfolio Solutions, LLC. Upon the closing of the HRC Asset Acquisition, the Current Support Services Agreement will terminate, and a new Fund Support Services Agreement, having terms and conditions substantially similar to the Current Support Services Agreement, will be entered into by and between the Fund and BIM.

No changes are currently being proposed with respect to the Fund's other service providers, including transfer agent, administrator and custodian. However, following the closing of the Transaction, the Board of Trustees may consider whether to replace certain service providers with the service providers currently utilized by other funds in the Brookfield fund complex.

Affiliated Brokerage and Other Payments to Affiliates

During the fiscal year ended November 30, 2016 (the most recent fiscal year for which such information is available), the Fund paid no brokerage commissions to (i) any broker that is an affiliated person of the Fund or an affiliated person of such person, or (ii) any broker an affiliated person of which is an affiliated person of the Fund or the Advisor.

During the fiscal year ended November 30, 2016 (the most recent fiscal year for which such information is available), the Fund made no material payments to the Advisor or any affiliated person of the Advisor for services provided to the Fund (other than pursuant to the Current Advisory Agreement).

Board Considerations

The Board of Trustees met in person on July 24, 2017 to consider approval of the New Advisory Agreement. The Board of Trustees noted that they had most recently approved the continuation of the Current Advisory Agreement on May 25, 2017 and reviewed the material they had received from the Advisor in connection with that approval of the factors considered by the Board in reaching its conclusion that the continuation of the Current Advisory Agreement was in the best interest of the Fund. In addition, the Board of Trustees noted that in advance of the July 24, 2017 in person meeting, Mr. Tutcher, in his capacity as Chair of the Board and principal of the Advisor, had met and communicated with the Independent Trustees regularly to keep them informed regarding the Transaction and answer questions that they had. At the July 24, 2017 meeting, the Board met with representatives of the Advisor and of BIM. The

Board also met in person on October 26, 2017 with representatives of the Advisor who apprised the Board of further developments with respect to the Transaction that occurred between the Board's July 24, 2017 meeting and the signing of the Purchase Agreement. At the October 26, 2017 meeting the Board ratified and affirmed their prior approvals.

In connection with the Board's review, BIM provided, and the Board obtained, information regarding Brookfield, the Brookfield public securities group and BIM, including with respect to Brookfield's business lines, competitive advantages, global scale and investment flexibility, and the Public Securities Group's complementary fit within Brookfield, investment principals, experience of its leadership team, range of investment strategies and vehicles, performance track record, distribution support, marketing platform and strategic vision. In addition, BIM provided, and the Board obtained, information regarding BIM's compliance programs, disaster recovery procedures, cybersecurity measures and operational risk evaluations. The Board also received and reviewed a copy of the New Advisory Agreement and Interim Advisory Agreement.

Representatives of the Advisor and BIM discussed how the Center Coast team would operate within the Brookfield Public Securities Group, the resources of Brookfield that would support the Center Coast team and their belief that being part of Brookfield would be additive to the Center Coast team. The representatives of the Advisor and BIM discussed Brookfield's experience managing assets in the MLP and infrastructure sectors and confirmed that the current portfolio managers would continue to manage the Fund according to the same objectives and policies as before, and that significant changes to the Fund's investment operations are not anticipated. Representatives of BIM and the Advisor discussed the future plans with respect to service providers to the Fund.

Below is an overview of the primary factors the Boards considered in connection with the review of the respective Interim Advisory Agreement and the New Advisory Agreement. In reaching this conclusion for the Fund, no single factor was determinative in the Board's conclusion, but rather the Board considered a variety of factors.

Consideration of Nature, Extent and Quality of the Services

The Board, including the Independent Trustees, considered that in connection with its most recent approval of the continuation of the Current Advisory Agreement it had received and considered information regarding the nature, extent and quality of services to be provided to the Fund in light of the investment objective, policies and strategies of the Fund. The Board noted that in connection with such review it had reviewed and considered the Advisor's investment advisory personnel, its history as an asset manager, performance of other accounts managed by the Advisor, the amount of its current assets under management, the research and decision-making processes utilized by the Advisor, including the methods adopted to seek to achieve compliance with the investment objectives, polices and restrictions of the Fund, the background and experience of the Advisor's management in connection with the Fund, including the qualifications, backgrounds and responsibilities of the management team primarily

responsible for the day-to-day portfolio management of the Fund and the extent of the resources devoted to research and analysis of the Fund's actual and potential investments. The Board considered that the manner in which the Center Coast team would operate within Brookfield, and the fact that the current portfolio managers would continue to manage the Fund. The Board considered the manner in which the reputation and size of Brookfield may benefit the Center Coast team and the Fund. The Board noted the experience and resources of Brookfield and BIM and that within the Brookfield Public Securities Group, the Center Coast team may benefit for enhanced general support and oversight from certain functional groups such as legal, finance, internal audit, compliance, and risk management. Based on their review, the Board concluded that the nature, extent and quality of services provided to the Fund were expected to continue at the same or improved levels following the Transaction.

Consideration of Advisory Fees and the Cost of the Services

The Board, including the Independent Trustees, considered that in connection with its most recent approval of the continuation of the Current Advisory Agreement it had received and considered information regarding the Fund's contractual annual advisory fee and anticipated overall expenses with (a) a peer group of competitor closed-end funds identified by the Advisor and (b) other products managed by the Advisor and that given the small universe of managers fitting within the criteria for the peer group, the Advisor had not believed that it would be beneficial to engage the services of an independent third-party to prepare the peer group analysis and that the Independent Trustees had concurred with this approach. Based on such information, the Board had determined that the proposed contractual annual advisory fee of 1.00% of the Fund's managed assets was equal to the median contractual advisory fee rate of funds within the peer group and that the fee structure was competitive with fee structures applicable to other similar products managed by the Advisor. The Board considered that the contractual annual advisory fee would remain unchanged under the Interim Advisory Agreement and New Advisory Agreement. The Board noted that while certain terms of the New Advisory Agreement differed from the Current Advisory Agreement, in order to conform the terms of the New Advisory Agreement to BIM's advisory agreements with other closed-end funds it managed, Brookfield had represented that the New Advisory Agreement and Current Advisory Agreement were substantially similar and no material changes were proposed. The Board concluded that the investment advisory fees to be received by BIM were comparable to the fees charged to other investment vehicles within the Fund's peer group and to other clients of the Advisor in broadly comparable investment products.

Consideration of Investment Performance

The Board, including the Independent Trustees, considered that in connection with its most recent approval of the continuation of the Current Advisory Agreement it had received and considered information regarding the Fund's performance and comparisons of that performance to similar MLP closed-end funds along with the Alerian MLP index. The Board noted that the current portfolio managers would continue to manage the Fund according to the same objectives and policies as before, and

that significant changes to the Fund's investment operations are not anticipated. The Board concluded that the investment performance of the Fund supported approving the Interim Advisory Agreement and New Advisory Agreement.

Other Considerations

The Board, including the Independent Trustees, considered that in connection with its most recent approval of the continuation of the Current Advisory Agreement it had considered the anticipated profits, if any, to be realized by the Advisor in connection with the operation of the Fund and concluded that the profit, if any, anticipated to be realized by the Advisor in connection with the operation of the Fund was not unreasonable. The Board noted that it was too early to predict how the Transaction may affect future profitability, but noted that contractual fee rates under the Interim Advisory Agreement and the New Advisory Agreement are the same as those assessed under the Current Advisory Agreement.

The Board, including the Independent Trustees, considered that in connection with its most recent approval of the continuation of the Current Advisory Agreement it had considered whether economies of scale in the provision of services to the Fund will be passed along to the shareholders under the proposed agreements and concluded there were currently no or de minimis material economies of scale or other incidental benefits accruing to the Advisor in connection with its relationship with the Fund. The Board further noted that representatives of BIM had indicated that such economies of scale could not be predicted in advance of the closing of the Transaction.

The Board, including the Independent Trustees, considered other benefits to BIM, Brookfield and their affiliates expected to be derived from their relationships with the Fund as a result of the Transaction. The Board considered that pursuant to the HRC Asset Acquisition BIM would enter into a replacement agreement for the Fund Support Agreement, and would provide fund support services in exchange for a fee payable by the Fund.

In addition to the factors above, the Board, including the Independent Trustees, also considered the following:

• Center Coast would rely on the provisions of Section 15(f) of the 1940 Act. In this regard, Brookfield had agreed to conduct its business so as to assure that for a period of not less than two (2) years after the closing, neither Brookfield nor any of its affiliates will impose or seek to impose on the Fund an "unfair burden" as a result of the Transactions, or any express or implied terms, conditions or understandings applicable thereto.

• The Fund would not incur any costs in seeking the necessary shareholder approvals for the New Advisory Agreement or the election of the Trustee Nominees identified herein.

• The reputation, financial strength and resources of Brookfield.

• The long-term investment philosophy of Brookfield and anticipated plans to grow the Center Coast team's business to the benefit of the Fund.

• The proposed HRC Asset Acquisition, and the resulting continuity in the provision of fund support services to the Fund, including the expected continuity in personnel providing such services, and that the overall scope and level of services that are currently provided to the Fund will not change and the Fund's cost for these services will not change.

As a result of its review and consideration of the Interim Advisory Agreement and the New Advisory Agreement and Interim Advisory Agreement in connection with the Transaction, at a meeting on July 24, 2017, the Board, including the Independent Trustees voting separately, voted unanimously to approve the Interim Advisory Agreement and the New Investment Advisory Agreement and to recommend the New Advisory Agreement to Fund shareholders for their approval. Following the signing of the Purchase Agreement, at an in person meeting held on October 26, 2017, the Board unanimously reaffirmed its approval of the Interim Advisory Agreement and the New Investment Advisory Agreement and its recommendation of the New Advisory Agreement to Fund shareholders for their approval.

Shareholder Approval

To become effective, the New Advisory Agreement must be approved by a vote of a majority of the outstanding voting securities of the Fund, with the holders of Common Shares and Preferred Shares voting together as a single class. The "vote of a majority of the outstanding voting securities" is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the Shares of the Fund entitled to vote thereon present at the meeting if the holders of more than 50% of such outstanding Shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding Shares of the Fund entitled to vote thereon. AbstentionsMeeting, abstentions and broker "non-votes" (i.e.,(that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote sharesShares on a particular matter with respect to which the brokers or nominees do not have discretionary power), if any, will be consideredtreated as Shares that are present for quorum purposes of determining quorum. For purposes of the proposal, abstentions and broker "non-votes,but not "entitled to vote." if any,Abstentions will have the same effect as votes against the proposal.

effect as votes against Proposal 1. Broker "non-votes" will have no effect on the outcome of the vote on Proposal 1. Since banks and brokers will have discretionary authority to vote Shares in the absence of voting instructions from shareholders with respect to Proposal 1, we expect that there will be no broker "non-votes."

Shareholders who execute proxies retain the right to revoke them by: (a) written notice received by the Secretary of the Fund at any time before that proxy is exercised; (b) signing a proxy bearing a later date or; (c) attending the Meeting and voting in person (attendance at the Meeting will not, by itself, revoke a properly executed proxy). If you hold your Shares in "street name" (that is, through a broker or other nominee), you should instruct your broker or nominee how to vote your Shares by following the voting instructions provided by your broker or nominee.

In order to participate in and vote your Shares at the Meeting, shareholders as of the Record Date need to register for the Meeting.

If you are a registered holder, and wish to attend and vote at the Meeting, you must:

• Send an email including your full name and address to the Fund's proxy solicitor, AST Fund Solutions, LLC ("AST"), at attendameeting@astfinancial.com with "Center Coast Brookfield MLP & Energy Infrastructure Fund virtual meeting" in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting. You will need the control number found on your proxy card as part of the registration process.

If your Shares are registered in the name of your broker, bank, or other agent, you are the "beneficial owner" of those Shares and those Shares are considered as held in "street name." If you hold your Shares in "street name" and wish to attend and vote at the Meeting, you must:

• Obtain a legal proxy from your broker, bank or other nominee reflecting the Fund's name, the number of Shares you held as of the Record Date, as well as your name and address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy via email to AST at attendameeting@astfinancial.com with "Legal Proxy" in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting.

You will receive a confirmation of your registration by email after AST receives your registration materials. If you wish to vote your Shares electronically at the Meeting, please follow the instructions provided by AST

in its confirmation email. On the day of the Meeting, we encourage you to access the Meeting prior to start time leaving ample time to check in.